HELPFUL LINKS

Imagine what $5,000 could do for your business right now. Where can you get the money you need to grow your dream and invest in your business’s future? Start-ups and small businesses in Northeast Indiana have another option for securing capital. Kiva Hub Northeast Indiana, a crowdfunded microlending center, has opened at The NIIC with the collaboration and support of The City of Fort Wayne, SEED, and the Indiana Economic Development Corporation. Kiva Northeast Indiana offers distinct advantages to newer, smaller businesses that may lack the credit history to secure a traditional bank loan. Kiva will not reject an entrepreneur because of their credit, net worth, or years in business. Instead, Kiva’s crowd-sourced model determines borrowers’ creditworthiness through “social underwriting” based on character and reputation.

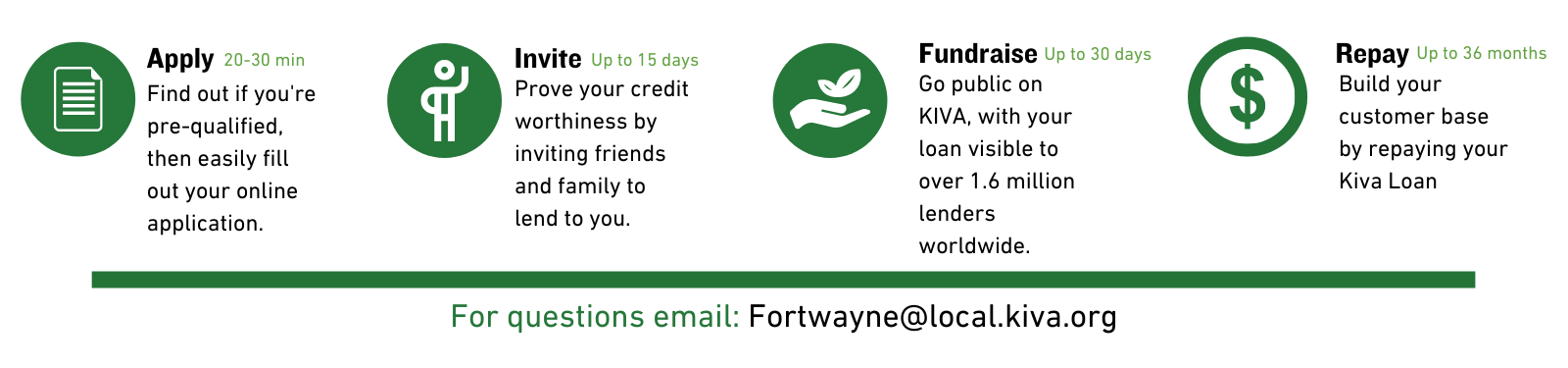

What does that mean for you, the borrower? Gather 5-40 of your friends and family and ask them to give you a loan of $25 through KIVA. They help you get started, and then you have access to KIVA‘s worldwide lending pool of committed supporters of businesses like yours!  Through Kiva Northeast Indiana, individuals can support loans to local entrepreneurs with contributions beginning at $25. These funds are pooled and loaned to those who may experience difficulty securing traditional bank loans. Borrowers can access up to $15,000 at 0% interest with no fees. Globally, Kiva loans have a 97% repayment rate. What can you do with your loan from KIVA, a 501(3) Non-profit lending platform?

Through Kiva Northeast Indiana, individuals can support loans to local entrepreneurs with contributions beginning at $25. These funds are pooled and loaned to those who may experience difficulty securing traditional bank loans. Borrowers can access up to $15,000 at 0% interest with no fees. Globally, Kiva loans have a 97% repayment rate. What can you do with your loan from KIVA, a 501(3) Non-profit lending platform?

- Use funds to hire a part-time employee

- Purchase a new piece of equipment

- Grow your inventory

Katrina used her loan to purchase a new sewing machine, helping her take her business to the next level. Sarah used her loan to purchase a sign for her new location, helping her stand out and attract new business. Ready for the next step? Apply now or send us an email fortwayne@local.kiva.org and we would be happy to answer your questions.

KIVA Northeast Indiana is possible through The NIIC and collaboration and support of The City of Fort Wayne, SEED, and the Indiana Economic Development Corporation. Kiva Northeast Indiana is part of WBC EmPWR Program, a one-year initiative funded by the U.S. Small Business Administration (SBA) Office of Women’s Business Ownership (OWBO).